Platinum, a rare and valuable precious metal, has been prized for its beauty and utility for centuries. As an investment, physical platinum in the form of coins, bars, and rounds offers a tangible asset that can diversify a portfolio. This guide will explore the options available when buying physical platinum, including the different forms, where to buy it, considerations for storage and security, and the benefits of investing in this precious metal.

Platinum is a versatile metal with a wide range of industrial applications, from catalytic converters in automobiles to use in electronics, jewelry, and medical equipment. Its scarcity and enduring demand make it an attractive option for investors seeking to diversify their portfolios beyond traditional assets like stocks and bonds.

Diversification: Platinum offers diversification benefits due to its low correlation with other asset classes.

Inflation Hedge: It can hedge against inflation and currency fluctuations.

Industrial Demand: Strong industrial demand provides fundamental support for its value.

Store of Value: Like gold and silver, platinum is considered a value store during economic uncertainty.

When considering an investment in physical platinum, investors have several options. The most common forms are coins, bars, and rounds.

Platinum Coins

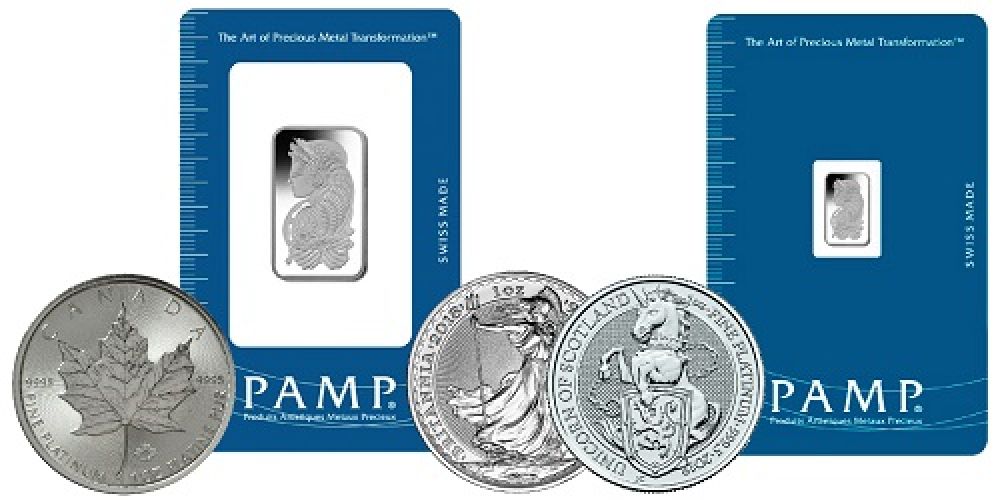

Platinum coins are minted by government mints worldwide and are typically issued in various denominations and weights. Some of the most popular platinum coins include:

American Platinum Eagle: Issued by the United States Mint, the American Platinum Eagle comes in one-ounce, half-ounce, quarter-ounce, and tenth-ounce sizes.

Canadian Platinum Maple Leaf: The Royal Canadian Mint produces the Canadian Platinum Maple Leaf in various sizes, including one-ounce, half-ounce, quarter-ounce, and one-tenth-ounce.

Australian Platinum Koala: The Perth Mint in Australia issues the Platinum Koala coin in one-ounce and fractional sizes.

Platinum coins are generally sold at a premium over the current spot price of platinum due to their collectible and numismatic value, in addition to their intrinsic metal content.

Platinum Bars

Platinum bars are another popular option for investors purchasing larger quantities of the metal. These bars are typically produced by private mints and refineries worldwide and are available in a wide range of weights, from 1 gram to 1 kilogram or more.

Johnson Matthey Platinum Bars: Johnson Matthey, a renowned refiner, produces platinum bars in various sizes and designs, including the classic rectangular shape with the company logo, weight, and purity stamped on the bar.

PAMP Suisse Platinum Bars: PAMP Suisse, based in Switzerland, offers platinum bars with intricate designs and features, including the popular Fortuna series.

Platinum bars generally carry a lower premium than coins and can efficiently acquire more significant amounts of platinum.

Platinum Rounds

Platinum rounds are similar to coins but are not considered legal tender. Private mints produce them and are typically available in sizes ranging from 1 ounce to 10 ounces.

Engelhard Platinum Rounds: Engelhard, a respected name in precious metals, produces platinum rounds that collectors and investors highly seek.

Sunshine Mint Platinum Rounds: Sunshine Minting Inc., known for its high-quality products, offers platinum rounds in various designs and sizes.

Platinum rounds often carry lower premiums than coins and can be a cost-effective way to invest in platinum for investors prioritizing the metal content over collectible value.

There are several reputable sources where investors can purchase physical platinum, including:

Bullion Dealers: Online bullion dealers offer a wide selection of platinum coins, bars, and rounds, often at competitive prices. Some well-known dealers include JM Bullion, APMEX, and Provident Metals.

Government Mints: Government mints such as the United States Mint, Royal Canadian Mint, and Perth Mint sell platinum coins directly to the public through their websites or authorized distributors.

Local Coin Shops: Brick-and-mortar coin shops often carry a selection of platinum coins and bars for immediate purchase. They may also offer competitive pricing and the ability to inspect the physical product before buying.

Purity and Authenticity

Ensure that any platinum product you purchase is of high purity. Platinum bars and coins typically range from .9995 delicate (99.95% pure) to .9999 fine (99.99% pure). Reputable dealers and mints will provide a certificate of authenticity with each purchase.

Premiums

Understand the premiums associated with different forms of physical platinum. Coins generally carry higher premiums due to their collectible and numismatic value, while bars and rounds may offer a lower premium for the same metal weight.

Storage and Security

Consider how you will store your physical platinum. Options include:

Home Safe: Investing in a quality home safe can provide immediate access to your platinum while keeping it secure.

Safe Deposit Box: Renting a safe deposit box at a bank or secure facility offers protection against theft and loss.

Selling Platinum

Before purchasing, consider how and where you will sell your platinum when the time comes. Establish relationships with reputable dealers or consider online platforms that facilitate the buying and selling precious metals.

Investing in physical platinum can be a rewarding way to diversify your investment portfolio and protect your wealth against economic uncertainties. Whether you choose platinum coins, bars, or rounds, understanding the market, purity, premiums, and storage options will help you make informed decisions when buying this rare and valuable metal.

Your phone / email address will not be published. Required fields are marked *