Gold

Where Luxury Meets Legacy

Gold's beauty, rarity, and enduring value have captivated mankind for generations. Gold bullion is a popular investment option for people wishing to preserve and expand their money because it is a tangible asset. We'll look at the benefits of purchasing gold bullion and why it's still a viable investment option in today's volatile financial climate. Gold bullion comes in various forms, including coins, bars, and rounds. Each type offers unique features and benefits to investors and collectors.

Gold Investment, Gold Returns

The current market price of gold per troy ounce is referred to as the spot price of gold. It is used to determine the price of gold bullion. Global supply and demand dynamics, investor mood, economic indices, and geopolitical concerns all influence the spot price.

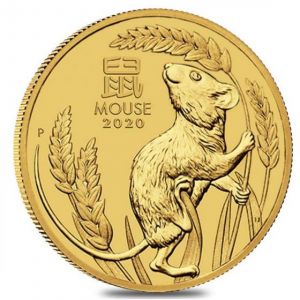

Gold Coins

Gold Coins

Are produced by government mints and are recognized worldwide for their purity, content, and legal tender status. Some popular examples include the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand. Gold coins typically have a high level of purity, often 99.99% or 99.9%. They come in a variety of weights, ranging from fractional ounces to one ounce or more. Gold coins bear iconic designs and are widely recognized and accepted globally, making them easily tradable.

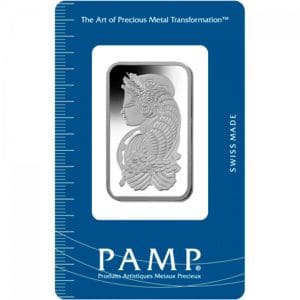

Gold Bars

Private refineries and mints produce gold bullion bars, commonly known as ingots. These bars offer a cost-effective way to acquire larger quantities of gold. Gold bars are available in a variety of weights, from fractional amounts (e.g., 1 gram) to bigger bars weighing 1 ounce, 10 ounces, 1 kilogram, or more. They typically have high levels of purity, often 99.99% or 99.9%. Gold bars often carry lower premiums over the gold spot price compared to coins, making them an economical choice for investors looking to acquire larger quantities of gold. The uniform shape and flat surface of gold bars make them easy to stack and store securely.

Gold Rounds

Gold rounds, also known as medallions or private mint coins, are produced by private mints and resemble coins but lack legal tender status. Gold rounds are typically produced in various weights, similar to gold coins, and maintain high levels of purity, often 99.9% or 99.99%. Gold rounds often feature unique designs or themes, providing collectors with a wide range of options to choose from. Gold rounds can sometimes be more affordable than government-issued gold coins due to lower production costs and premiums.

Numasmatic Gold

CPG Your Source for Numasmatic Gold Services

Welcome to Canada Premium Gold, your premier destination for top-quality numismatic gold services in Canada. With our extensive range of exquisite gold coins and expert services, we cater to both collectors and investors who appreciate the beauty and historical significance of numismatic gold.

Whether you're an avid collector, an investor seeking a tangible asset, or someone looking for a meaningful gift, Canada Premium Gold is your trusted partner in the world of numismatic gold. Explore our collection, experience our exceptional services, and embark on a journey that combines beauty, history, and enduring value.

Overview

Gold coins, bars, and rounds are all viable options for investors and collectors seeking to acquire physical gold. Whether you prefer the recognized and trusted designs of government-issued gold coins, the cost efficiency of gold bars, or the variety and uniqueness of gold rounds, each form offers its own advantages. Ultimately, the choice between gold bullion coins, bars, and rounds depends on individual preferences, investment goals, and budget considerations.